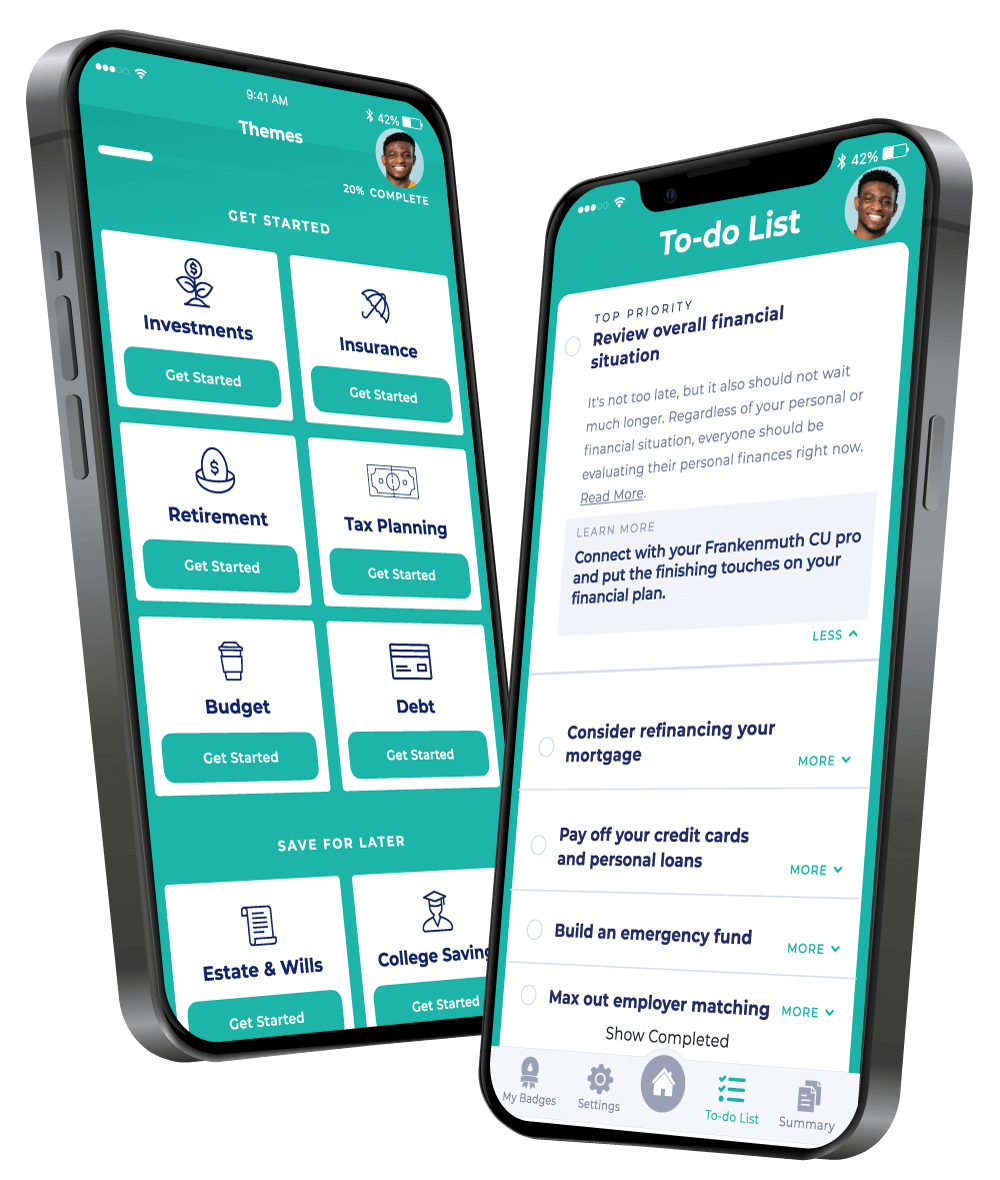

What is Pocketnest?

Pocketnest is a financial wellness platform Frankenmuth Credit Union partnered with to offer you comprehensive financial planning support. Your financial institution will continue to give you the great benefits they’ve always provided you.

How can Pocketnest help me?

Pocketnest can help you pursue financial wellness in just 3 minutes a week. The platform—located inside Frankenmuth Credit Union’s Consumer Online Banking checking and savings menus—will walk you through all 10 themes of personal finance, identifying gaps in your financial plan and giving you custom recommendations to fill them.

What are the 10 themes of personal finance?

- Net Worth Snapshot

- Budget

- Debt Management

- Insurance

- Investment

- Tax Planning

- Estate and Wills

- College Savings

- Retirement Planning

- Annual Review

How to save money when you’re broke

Whether you’re 22 or 42 (or 102!), it’s a balancing act between saving and spending your hard earned money, especially when cash is tight. And, we know cash can be tight for many reasons. Maybe you’re just starting out, or just had a child, or lost your job or had some unexpected emergency work done on your home or car.

Whatever the reason, we all know money doesn’t grow on trees. And, by the way, most of us have had that “oh my” moment when we were scraping the bottom of the barrel to make rent. Now, while it’s critical to make sure you’re paying your bills, we also know that it’s important to save for your future (or for your safety net, should a(nother) emergency pop up).

Did you know that 70 percent of the total 45 million student loan borrowers(1) have delayed saving for retirement because of their student loan debt? That’s not surprising, when you realize that there’s a total of $1.6 trillion in total outstanding student loan debt(1 )and, not to mention, $930 billion in US credit card debt(2).

Hold up! Before you grab the paper bag, don’t worry! Another necessity? We believe in the importance of enjoying your life—without absolutely draining yourself in the process of paying off bills and saving for the future. With some structure, hard work and self love, you can achieve a solid balance, and have some fun in the process. We’ll help.

Follow the below guidelines to help you to save money while on a tight budget. We’ll walk you through each step that will set you up for success in both your budget and future savings.

-

Do a quick financial check-in

Saving is your KEY to success! But, your very first step is to take a few minutes to do a quick financial wellness check. Before you start allocating funds to your savings account, make sure you’ve set a solid budget (that you can actually commit to following), understand your cash flow, and know where that next dollar goes. From here, you’ll know how much money you have, how much money you owe (think: student loans, mortgage, car), and how much money you have left over.

-

Start saving now

If you haven’t started already, now is the best time ever to begin saving any extra cash you come across. It doesn’t have to be a big commitment, either. Starting small is better than not starting at all. If you find yourself with a little leftover money at the end of the month (after you’ve paid down debt and bills) put aside a portion of it for later. Think of it as paying yourself and paying your bills. You can also consider rounding up your receipt on your “pleasure purchases” like eating out, and put the extra cash away. Believe us, your bank account will love you for it. And, more importantly, “future you” will love you even more.

-

Focus on balance

Paying off debt and stashing some cash away for the future feels AWESOME. But, it can get super draining if you go too long without a small reward. It’s certainly acceptable and feasible to treat yourself every now and then! Use a small chunk of leftover money for a little pleasure—maybe treat yourself to a small meal or a new “toy” or a massage. All you have to do is make sure all of your finances are balanced. Set aside a certain amount each month for a “fun fund,” and make sure to stay on top of your budget.

- Build an emergency fund

You never know when an emergency may come around. Creating an emergency fund will give you an extra cushion if you ever find yourself in the hole from unforeseen emergencies like medical crises, home repairs or if you lose your job. Having an emergency cash reserve is a crucial safety net. No safety net means more potential debt. After you learn how to set up your emergency fund, you’ll also want to know when it’s appropriate to use your emergency fund.

- Set up your retirement fund

Take a hot second and look into what kind of retirement account your employer offers—it could be a 401(k), 403(b), or a Roth or Traditional IRA. Determine how much you should save for retirement to ensure you’re saving enough for your future for how you expect your lifestyle to be. If you have multiple retirement accounts, you can consider rolling over your retirement accounts into one. There are pros and cons to rolling over your 401(k), so take some time to review your options. And, lastly, if your employer doesn’t offer a retirement plan, that’s okay, too! You have options.

-

Set up monthly transfers

Think of this concept as an automatic bill payment to yourself. Just like you can select autopay for your monthly credit card payments, you can also select an automatic payment from your checking account to your savings account. This little #SavingsHack will help you set aside money for the future without having to lift a finger (well, after you set up the automatic transfer, of course!).

-

Stay on track with your plan

Throughout this process, you’ll want to ensure you have your budget completely up to date. Try to stay away from any unnecessary expenses. If you want to go out with your pals for a yummy breakfast or to see the latest movie getting rave reviews, go for it, but take those purchases into account as soon as possible and stay within your budget. Remember, emergencies happen! So, it’s possible you might need to readjust your budget to your current situation. You can always take a step back and do another quick financial wellness check to ensure you’re still on track with your finances.

- When you’re ready, consider the markets

Once you find yourself in a stable financial place, consider investing in the markets. Setting aside some extra cash for the markets can also help you save up for your future especially if you can do so in a tax deferred account. We recommend taking small steps in your investment journey, with one manageable bite at a time. Especially if you’re investing during a time with a tight budget, we recommend doing your research and taking it slow.

(1)Forbes “Student Loan Debt Statistics In 2020: A Record $1.6 Trillion.” February 3, 2020 (2)CNBC “Credit card debt in the U.S. hits all-time high of $930 billion—here’s how to tackle yours with a balance transfer.” July 16, 2020

Trim your budget coach

Why should I link my bank accounts?

Linking your bank account helps us create your comprehensive financial plan and ensures accuracy, since many aspects of your plan are centered around your current situation. Pocketnest analyzes your transactions with trusted partners to give you custom advice, help you save money, and build your net worth. Read our complete privacy policy for more information.

What is the DIY approach to financial wellness?

The DIY approach to financial wellness involves step-by-step coaching to help users achieve financial wellness on their own. It is designed to be simple, quick, and accessible, requiring only 3 minutes a week and eliminating the need for jargon, fees, or in-person meetings.

Build an emergency fund

Is Pocketnest secure?

Yes! Pocketnest uses enterprise-grade best practices to protect user data. Data is encrypted both in-transit using TLS and at rest. The platform does not store institution login information and does not have access to generate any financial transactions on users’ behalf. Pocketnest follows the NIST security framework to guide security practices and governance. The platform is SOC II Type 2 compliant, completes third-party Pen-Testing, and is trusted by more than 50 enterprise institutions.

Who can see my data?

Only your financial institution and Pocketnest can see your data. Pocketnest only stores data crucial to users’ financial wellness journey—with explicit user permission. Securely stored in partnership with one of the largest data aggregators, Plaid, this data enables Pocketnest to provide users a highly interactive and productive online experience.

Frankenmuth Credit Union (FCU) does not offer tax advice. Be sure to discuss your specific financial planning decisions, tax situation, or retirement preparation needs with your accountant or other financial and tax advisors. There is no charge to use the Pocketnest platform/application. Data and connectivity fees from your mobile service provider may apply. Please contact your mobile service provider for more information. By using the Pocketnest Financial Wellness platform/application, you waive any rights or claims you may have against Frankenmuth Credit Union related to your use of or reliance on the information provided through this product and related services.